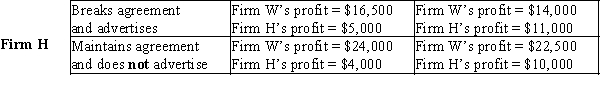

Table 17-29

Suppose that two firms, Wild Willy's Wonderdrink (Firm W) and Hyper Hank's Hydration (Firm H) , comprise the market for energy drinks. Each firm determines that it could lower its costs and increase its profits if both firms reduced their advertising budgets. But for the plan to work, each firm must agree to refrain from advertising. Each firm believes that advertising works by increasing the demand for the firm's energy drinks, but each firm also believes that if neither firm advertises, the cost savings will outweigh the lost sales. The table below lists each firm's individual profits:

Firm W

Breaks agreement Maintains agreement

and advertises and does not advertise

-Refer to Table 17-29. Which of the following statements does not correctly characterize the outcome of this game?

Definitions:

Silver Futures

Contracts to buy or sell silver at a future date at a predetermined price, often used for hedging or speculative purposes.

S&P 500 Index

A stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States, widely regarded as the best single gauge of large-cap U.S. equities.

Pork Bellies

Futures contracts traded on the commodity markets, representing 40,000 lbs of frozen, trimmed bellies from hogs, which are used to make bacon.

Cash Delivery

The process of settling a futures or options contract by exchanging the cash equivalent of the asset rather than the physical asset itself.

Q31: Refer to Table 18-5. How many workers

Q84: The problems faced by oligopolies with three

Q125: Monopolistically competitive firms, like monopoly firms, maximize

Q277: Because oligopoly markets have only a few

Q307: Why do economists use game theory to

Q351: The theory of labor supply is based

Q364: Which of the following would increase the

Q366: Refer to Table 18-9. What is the

Q404: Refer to Table 17-12. Suppose we observe

Q587: Refer to Scenario 18-1. Suppose that Harry