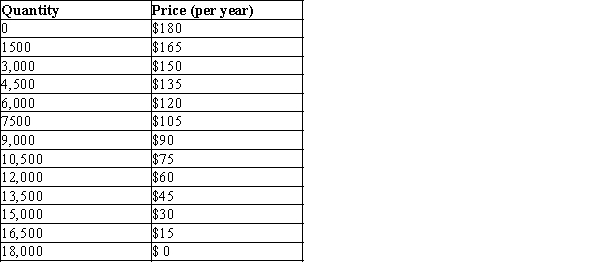

Table 17-5

The information in the table below shows the total demand for premium-channel digital cable TV subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per year) to provide premium digital channels in the market area and that the marginal cost of providing the premium channel service to a household is zero.

-Refer to Table 17-5. Assume that there are two profit-maximizing digital cable TV companies operating in this market. Further assume that they are not able to collude on the price and quantity of premium digital channel subscriptions to sell. How much profit will each firm earn when this market reaches a Nash equilibrium?

Definitions:

Interest Rate

The amount charged by a lender to a borrower for the use of assets, usually expressed as a percentage of the principal amount.

APR

APR, or Annual Percentage Rate, is the annual rate charged for borrowing or earned through an investment, inclusive of any fees or additional costs associated with the transaction.

Zero-Interest Financing

A financing arrangement where the borrower does not pay any interest on the borrowed amount, often used as a promotional strategy by retailers.

Monthly Payments

Regular payments made each month, often associated with loans or leases, intended to repay borrowed money plus any applicable interest.

Q104: In a prisoner's dilemma, only one firm

Q245: Nike and Reebok (athletic shoe companies) are

Q261: Refer to Figure 16-5. Panel b is

Q275: Refer to Table 17-1. If Rochelle and

Q287: Refer to Figure 16-12. If this firm

Q319: Individual profit earned by Dave, the oligopolist,

Q361: Who has a greater opportunity cost of

Q423: Refer to Table 17-32. Is there a

Q425: Refer to Table 17-21. If John chooses

Q574: Refer to Figure 18-1. If the shop