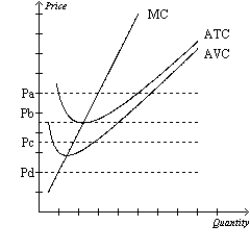

Figure 14-2

Suppose a firm operating in a competitive market has the following cost curves:

-Refer to Figure 14-2. If the market price is Pd, in the short run the firm will earn

Definitions:

Investment

This refers to the allocation of resources, often financial, in assets or projects with an expectation of generating future returns.

Lower Partial Standard Deviation

A measure of the risk of negative asset returns, focusing only on the volatility of returns that fall below the average.

Extremely Negative Returns

Refers to significantly below-average returns on investments, often resulting in substantial losses.

Value At Risk

A financial metric used to estimate the potential loss in value of a portfolio over a defined period for a given confidence interval.

Q209: Refer to Table 13-7. What is the

Q358: For a certain firm, the 100th unit

Q387: A dairy farmer must be able to

Q397: A government-created monopoly arises when<br>A)government spending in

Q533: When a firm experiences diseconomies of scale,<br>A)short-run

Q544: Refer to Table 13-8. What is the

Q562: In the short run, if the market

Q563: Suppose that a firm operating in perfectly

Q566: A firm in a competitive market has

Q602: Microsoft's government-granted exclusive right to make and