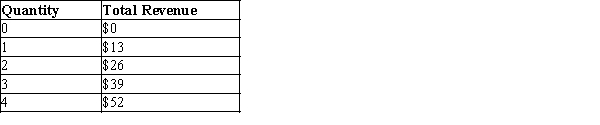

Table 14-3

The table represents a demand curve faced by a firm in a competitive market.

-Refer to Table 14-3. For this firm, the price is

Definitions:

Tax Difference

The variation between taxes expected to be paid versus those actually paid, due to differences in tax rates, tax laws, or differences in interpretation of tax liabilities.

Book Value

The net value of a company's assets subtracted by its liabilities and preferred stock, indicating what remains for common shareholders according to accounting standards.

Market Value

The existing cost for buying or selling an asset or company in the market.

Taxable Income

The amount of an individual's or entity's income used to determine how much tax is owed, calculated by deducting allowable deductions and exemptions from gross income.

Q40: When a firm is experiencing diseconomies of

Q62: Which of the following could be used

Q64: All firms maximize profits by producing an

Q76: When firms in a perfectly competitive market

Q149: Average total cost reveals how much total

Q169: Suppose that a firm operating in perfectly

Q178: Suppose that a firm operating in perfectly

Q223: For a large firm that produces and

Q324: Refer to Scenario 14-3. At Q=499, the

Q380: Several related measures of cost can be