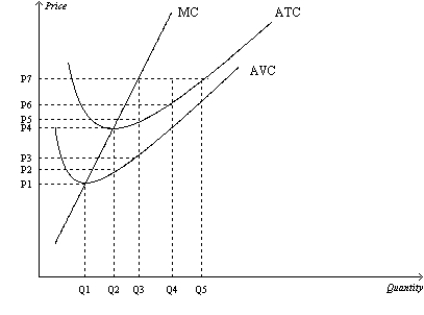

Figure 14-5

Suppose a firm operating in a competitive market has the following cost curves:

-Refer to Figure 14-5. When market price is P7, a profit-maximizing firm's short-run profits can be represented by the area

Definitions:

Income Tax Assessment Act

Legislation that outlines the rules and procedures for the assessment and collection of income tax in a jurisdiction.

Deferred Tax Asset

An accounting term for items that can be used to reduce future tax liability when certain conditions are met, such as allowances for doubtful accounts.

Deferred Tax Liability

A tax obligation that arises from temporary differences between the book value and tax value of assets and liabilities, payable in future periods.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against an asset since it was acquired, reflecting its usage and wear and tear over time.

Q26: Constant returns to scale occur when a

Q38: A firm produces 300 units of output

Q140: A firm operating in a perfectly competitive

Q156: The total cost to the firm of

Q244: Refer to Table 14-12. What is the

Q328: Refer to Figure 14-5. In the short

Q358: For a certain firm, the 100th unit

Q360: In the long run, when price is

Q389: Firms in a competitive market are said

Q575: When it produces 500 units of output,