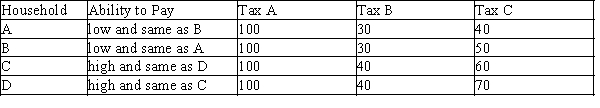

Table 12-13

The table below provides information on the 4 households that make up a small economy and how much they would pay in taxes under 3 types of taxes.

-Refer to Table 12-13. In this economy Tax C exhibits

Definitions:

Public Good

Nonexclusive and nonrival good; the marginal cost of provision to an additional consumer is zero and people cannot be excluded from consuming it.

Common Property Resource

A type of good consisting of natural or human-made resources where users have shared rights, often leading to problems of overuse or depletion.

Quota

A government-imposed trade restriction that limits the number, or monetary value, of goods that can be imported or exported during a specific time period.

Public Good

A product or service that is non-excludable and non-rivalrous, meaning its use by one individual does not reduce availability to others, and people cannot be effectively excluded from using the good.

Q6: Refer to Table 13-18. What is the

Q75: Describe how an accounting firm could experience

Q101: Suppose a firm currently produces 325 units

Q201: Suppose a recent increase in federal gasoline

Q231: Suppose that Kara values a hot fudge

Q259: Refer to Table 13-6. Each worker at

Q304: In which of the following tax systems

Q351: The Tragedy of the Commons occurs because<br>A)government

Q395: The value of a business owner's time

Q398: Refer to Scenario 12-4. The taxpayer faces<br>A)an