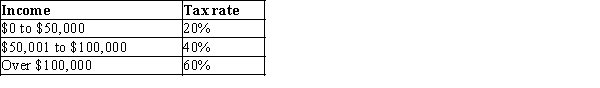

Table 12-5

-Refer to Table 12-5. What is the marginal tax rate for a person who makes $60,000?

Definitions:

Outstanding Voting

Refers to shares that are issued by a corporation, held by investors, and eligible to vote on corporate matters.

Consolidated Cost

The total cost of a project or investment after combining all individual costs and expenses.

Inventory Purchase Price

The cost incurred to acquire goods or materials held for sale or production in the business.

Q79: Suppose that a small county is considering

Q241: Neither public goods nor common resources are<br>A)excludable,

Q259: Refer to Table 11-2. Suppose the cost

Q290: What are the two types of costs

Q308: If James earns $80,000 in taxable income

Q347: Refer to Table 11-1. Suppose the cost

Q388: Suppose the government levies a "fat tax"

Q397: Two families who live in Plains, GA

Q427: Refer to Table 12-9. Harry is a

Q446: According to the mathematical laws that govern