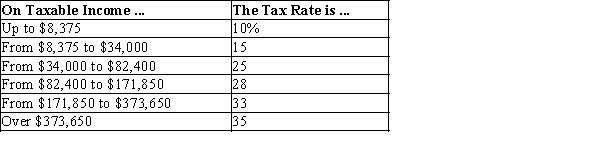

Table 12-10

-Refer to Table 12-10. If Miss Kay has $80,000 in taxable income, her tax liability is

Definitions:

Acquisition Costs

Expenses associated with acquiring new assets or investments, including legal fees, consulting fees, administrative costs, and other related expenses.

Property, Plant, Equipment

Long-term tangible assets owned by a business for use in the production or supply of goods and services, also known as fixed assets.

Speculation

The act of trading in an asset or engaging in a financial transaction that has a significant risk of losing most or all of the initial outlay, in expectation of a substantial gain.

Investments

Assets purchased with the expectation that they will generate income in the future or appreciate and be sold at a higher price.

Q93: In order to construct a more complete

Q161: After a recent spike in violent crime,

Q184: A budget deficit occurs when government receipts

Q289: To fully understand the progressivity of government

Q333: Pollution is a<br>A)problem that is entirely unrelated

Q360: Government spending is projected to rise over

Q361: If a tax takes a constant fraction

Q435: An internet radio broadcast is<br>A)excludable and rival

Q445: When the marginal tax rate equals the

Q500: Refer to Table 12-6. For this tax