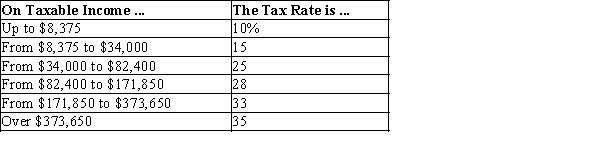

Table 12-10

-Refer to Table 12-10. If Jace has $33,000 in taxable income, his tax liability will be

Definitions:

Klinefelter Syndrome

A genetic condition that affects males, characterized by an extra X chromosome, leading to symptoms such as reduced fertility and physical developments typical of both sexes.

Fragile X Syndrome

A genetic condition causing intellectual disability, behavioral challenges, and physical anomalies, often due to a mutation on the X chromosome.

Down Syndrome

A genetic disorder caused by the presence of an extra chromosome 21, characterized by physical growth delays, characteristic facial features, and mild to moderate intellectual disability.

Genetic Counselor

A health professional with specialized training in genetics and counseling to provide individuals and families information on the nature, inheritance, and implications of genetic disorders.

Q5: An efficient tax system is one that

Q22: Private markets usually fail to provide lighthouses

Q121: Each of the following would be considered

Q255: Suppose that the Town of Mapledale is

Q363: In many cases, tax loopholes are designed

Q374: Refer to Table 12-15. In this tax

Q397: Each of the following explains why cost-benefit

Q416: Governments can grant private property rights over

Q488: If revenue from a gasoline tax is

Q537: Refer to Scenario 12-3. Assume that the