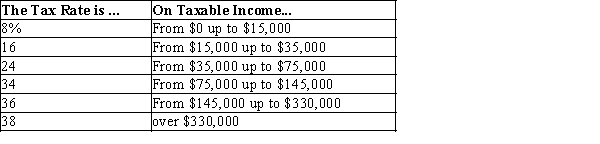

Table 12-11

-Refer to Table 12-11. If Peggy has taxable income of $43,000, her average tax rate is

Definitions:

Expenses

The costs incurred in the process of generating revenues, including costs of goods sold, operating expenses, and taxes.

Raw Materials

Basic materials that are used in the production process of manufacturing goods, often transformed into components or finished products.

Manufacturing Costs

Expenses directly related to the production of goods, including materials, labor, and overhead.

Work-in-Process Inventory

Goods in production but not yet completed; part of a company's inventory.

Q39: Which of the following is not a

Q116: What might cause economies of scale?

Q126: Refer to Figure 11-1. Which of the

Q149: In the 1980s, President Ronald Reagan argued

Q162: The marginal tax rates on the richest

Q164: Refer to Table 11-5. Suppose the cost

Q220: Lump-sum taxes are equitable but not efficient.

Q286: Refer to Scenario 11-1. Suppose Becky lives

Q388: Suppose the government levies a "fat tax"

Q555: The argument that each person should pay