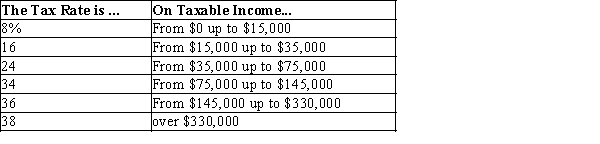

Table 12-11

-Refer to Table 12-11. If Peggy has taxable income of $43,000, her marginal tax rate is

Definitions:

Gross Domestic Product (GDP)

The total monetary or market value of all the finished goods and services produced within a country's borders in a specific time period, serving as a broad measure of overall domestic production.

Income Transfers

Financial transfers from individuals or groups to others without any exchange of goods or services, often part of social welfare programs.

National Income

The total amount of money earned within a country, including wages, profits, and taxes, minus subsidies.

Expansionary Fiscal Policy

Government policy that involves increasing spending, decreasing taxes, or both to stimulate economic growth.

Q2: An efficient tax system is one that

Q60: Changing the basis of taxation from income

Q96: Refer to Table 12-19. The tax system

Q180: Many economists believe that<br>A)the corporate income tax

Q235: You are trying to design a tax

Q277: Market failure associated with the free-rider problem

Q323: One benefit of the patent system is

Q369: If the government decides to build a

Q419: In 2014, what were the two largest

Q459: Which of the following tax systems is