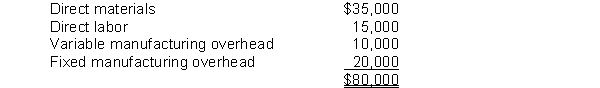

Coyle Company manufactured 6,000 units of a component part that is used in its product and incurred the following costs:

Another company has offered to sell the same component part to the company for $12 per unit. The fixed manufacturing overhead consists mainly of depreciation on the equipment used to manufacture the part and would not be reduced if the component part was purchased from the outside firm. If the component part is purchased from the outside firm, Coyle Company has the opportunity to use the factory equipment to produce another product which is estimated to have a contribution margin of $14,000.

Instructions

Prepare an incremental analysis report for Coyle Company which can serve as informational input into this make or buy decision.

Definitions:

Discount Rate

The discount rate applied in the calculation to ascertain the current value of forthcoming cash flows through discounted cash flow analysis.

Cash Inflows

The money received by a business from its various activities, such as sales, investments, financing, etc.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in a linear fashion.

Discount Rate

The interest rate used in discounted cash flow (DCF) analysis to determine the present value of future cash flows.

Q24: Use the following table, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3107/.jpg" alt="Use

Q40: Refer to Figure 10-10. "The social cost

Q109: Fehr Company is considering two capital investment

Q182: The source of data to serve as

Q183: Given below is an excerpt from a

Q199: Kwik Repair Service, Inc. is trying to

Q203: Which one of the following is not

Q228: In a market economy, government intervention<br>A)will always

Q273: Refer to Figure 10-12. An alternative label

Q341: Refer to Figure 10-9, Panel (b). The