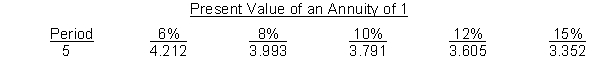

Yanik Company is considering investing in a project that will cost $162,000 and have no salvage value at the end of its 5-year life. It is estimated that the project will generate annual cash inflows of $45,000 each year. The company has a hurdle or cutoff rate of return of 8% and uses the following compound interest table:

Instructions

Using the internal rate of return method, determine if this project is acceptable by calculating an approximate interest yield for the project.

Definitions:

Debt-to-Equity Ratio

A gauge of a firm's financial risk, determined by dividing its overall debts by the equity of its shareholders.

Year 2

A term often used to refer to the second year of a business operation, project timeline, or financial plan.

Return on Equity

A measure of a company's profitability, indicating how much profit a company generates with the money shareholders have invested.

Year 2

Typically refers to the second year of an entity's operations, plan, or financial reporting.

Q9: Which of the following statements about overhead

Q19: A flexible budget report will show both

Q37: Costs incurred indirectly and allocated to a

Q40: A hurdle rate is the rate of

Q96: Net present value is the difference between

Q113: A profit center is<br>A) a responsibility center

Q125: Ruth Company produces 1,000 units of a

Q163: Negative externalities lead markets to produce<br>A)greater than

Q449: The difference between social cost and private

Q452: Josiah installed a metal sculpture in his