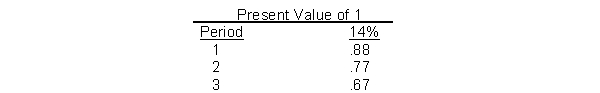

Woods Company wants to purchase an asset with a 3-year useful life, which is expected to produce cash inflows of $15,000 each year for two years, and $10,000 in year 3. Woods has a 14% cost of capital, and uses the following factors. What is the present value of these future cash flows?

Definitions:

Missouri River

The longest river in North America, flowing from the Rocky Mountains of western Montana to the Mississippi River in St. Louis, Missouri.

Pike's Journey

An expedition led by American explorer Zebulon Pike in the early 19th century, known for its exploration of the southwestern part of the Louisiana Territory and encounters with Spanish forces.

Louisiana Territory

A vast area of land acquired by the United States from France in 1803, doubling the size of the nation and driving westward expansion.

Western Expansion

The period of territorial growth and settler migration in the United States during the 19th century, leading to the acquisition and settlement of lands west of the Mississippi River.

Q61: When a policy succeeds in giving buyers

Q146: A flexible budget can be prepared for

Q172: A major accounting contribution to the managerial

Q187: Vega Company has developed the following

Q206: The two discounted cash flow techniques used

Q263: If education produces positive externalities and the

Q352: One drawback to industrial policy is that<br>A)technology

Q405: Refer to Figure 10-9, Panel (b) and

Q423: To enhance the well-being of society, a

Q501: Refer to Figure 10-16. This graph shows