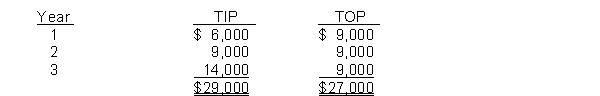

Sargent Company is considering two new projects, each requiring an equipment investment of $72,000. Each project will last for three years and produce the following annual net income.

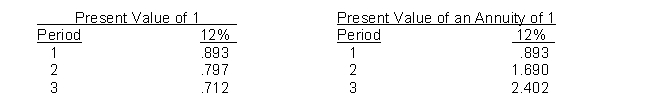

The equipment will have no salvage value at the end of its three-year life. Sargent Company uses straight-line depreciation. Sargent requires a minimum rate of return of 12%. Present value data are as follows:

Instructions

(a) Compute the net present value of each project.

(b) Which project should be selected? Why?

Definitions:

Confidential Information

Any data or information that is not meant to be shared with the public or unauthorized persons.

Costly Harm

Damage or injury that incurs a significant financial burden on the affected party.

File Number

An identifier assigned to a case, document, or record for tracking and organizational purposes.

Plaintiff

A party who initiates a lawsuit.

Q96: An advantage of the return on investment

Q122: Loomis Company uses both standards and budgets.

Q160: In using variance reports, top management normally

Q180: Refer to Figure 10-6. Which price represents

Q186: Refer to Figure 10-12. Which of the

Q189: Top management notices a variation from budget

Q196: In a make-or-buy decision, opportunity costs are<br>A)

Q261: Which of the following statements is not

Q427: Refer to Figure 10-4. If all external

Q529: Refer to Scenario 10-3. Suppose there is