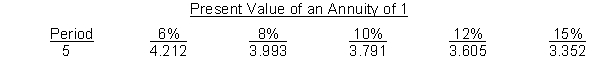

Yanik Company is considering investing in a project that will cost $162,000 and have no salvage value at the end of its 5-year life. It is estimated that the project will generate annual cash inflows of $45,000 each year. The company has a hurdle or cutoff rate of return of 8% and uses the following compound interest table:

Instructions

Using the internal rate of return method, determine if this project is acceptable by calculating an approximate interest yield for the project.

Definitions:

Corporate Direction

The strategic guidance and overall goals set by a company's leadership, defining its mission, vision, and long-term objectives.

Marketing Strategies

Plans designed to effectively allocate resources to achieve marketing objectives and maximize market share and profitability.

Prices

The sum of money needed to buy products or services.

Sales-Oriented

A business approach that prioritizes making sales and often involves aggressive sales tactics and strategies focusing on transactional outcomes.

Q38: Which of the following statements about budget

Q64: Which one of the following would be

Q76: Harbaugh Company recorded operating data for its

Q77: Flu shots provide a positive externality. Suppose

Q93: Marcus Company gathered the following data about

Q96: Net present value is the difference between

Q110: A standard cost is<br>A) a cost which

Q147: Kraus Company uses flexible budgets to control

Q182: The overhead _ variance is the difference

Q306: When the government intervenes in markets with