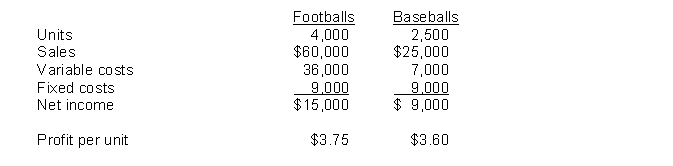

Ace Company makes 2 products, footballs and baseballs. Additional information follows:

Instructions

Ace has unlimited demand for both products. Therefore, which product should Ace tell his sales people to emphasize?

Definitions:

Tax Accounting

A method of accounting that focuses on taxes rather than the appearance of public financial statements.

Deferred Tax Liability

Deferred Tax Liability is a tax that is assessed or is due for the current period but has not yet been paid, often resulting from timing differences between book and tax deductions.

Economic Depreciation

A decrease in the value of an asset due to changes in market conditions or technology, as opposed to physical wear and tear.

Tax Deductible

Expenses that can be subtracted from gross income to reduce taxable income, effectively lowering the overall tax liability.

Q30: In Kapler Company, the Cutting Department had

Q33: Gunkle Company has budgeted direct materials purchases

Q43: Lester Production is planning to sell 600

Q50: Kenco Pharmaceuticals is evaluating its Brown division,

Q52: In CVP analysis, the term cost includes

Q67: CNC Company has the following information available

Q70: In Henderson Company, 50,000 units are produced

Q145: Fischer, Inc. provided the following information:

Q178: Physical units are 80,000. Total conversion costs

Q204: Lock Clothing Company's static budget at 2,000