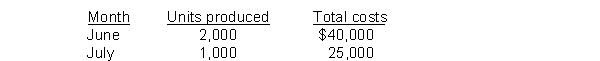

Tommy's Seafood used high-low data from June and July to determine its variable cost of $15 per unit. Additional information follows:  If Tommy's produces 2,300 units in August, how much is its total cost expected to be?

If Tommy's produces 2,300 units in August, how much is its total cost expected to be?

Definitions:

Indirect Method

A method used in cash flow statement preparation that adjusts net income for changes in non-cash accounts to calculate operating cash flow.

Net Cash Provided

Net cash provided is a financial metric representing the total amount of money generated by a company's operations after accounting for operational expenses and investments.

Accrued Liabilities

Liabilities that have been incurred, but have not yet been paid or recorded through a standard accounting transaction.

Financing Activities

Transactions and events where a business raises funds to finance its operations and expansions, often through borrowing or issuing equity.

Q14: During September, the capital expenditure budget indicates

Q27: If more units are produced than are

Q53: Brown Company produces flash drives for computers,

Q57: The best measure of the performance of

Q86: The difference between actual or expected sales

Q93: SEK Company's budgeted sales and direct materials

Q125: Cost centers, profit centers, and investment centers

Q144: Baker Winery manufactures a fine wine in

Q159: Sager Company's budgeted sales for April were

Q159: Barr Mfg. provided the following information from