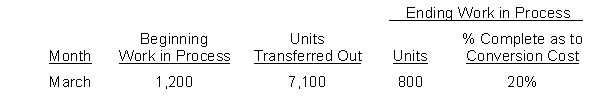

Sandusky Widget Company has the following production data for March.

Instructions

Compute the physical units for March.

Definitions:

Section 1245 Gain

Income derived from the sale or disposal of depreciable personal property, which may be recaptured as ordinary income.

Ordinary Income

Income earned from providing services, including wages, salaries, commissions, and income from businesses in which there is material participation.

Depreciation

A tax deduction reflecting the decrease in value of an asset over time due to wear and tear.

Section 1245

A tax code provision defining the treatment of gains from the sale of depreciable personal property, requiring that such gains be treated as ordinary income to the extent of depreciation taken.

Q1: A company has budgeted direct materials purchases

Q6: Fixed costs are $300,000 and the variable

Q24: Conceptually, any under- or overapplied overhead at

Q25: The following information is available for Elliot

Q31: Horizontal analysis is also called<br>A) linear analysis.<br>B)

Q47: Ensley, Inc. makes and sells a single

Q59: A company desires to sell a sufficient

Q60: The amount of revenue remaining after deducting

Q87: Both direct materials and indirect materials are<br>A)

Q160: Separate work in process accounts are maintained