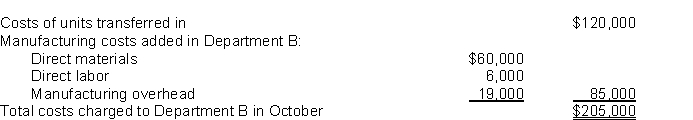

Benson Industries uses a process cost system. Products are processed first by Department A, second by Department B, and then they are transferred to the finished goods warehouse. Shown below is the cost information for Department B during the month of October:

The cost of work in process in Department B at October 1 is $25,000, and the cost of work in process at October 31 has been determined to be $30,000.

Instructions

Prepare journal entries to record for the month of October:

(a) The transfer of production from Department A to B.

(b) The manufacturing costs incurred by Department B.

(c) The transfer of completed units from Department B to the finished goods warehouse.

Definitions:

Interest Rates

The percentage charged by a lender to a borrower for the use of assets, usually expressed as an annual percentage of the principal loan amount.

Hotelling Rule

An economic theory that addresses how the price of non-renewable resources should increase over time under conditions of efficient extraction and market equilibrium.

Marginal Extraction Cost

The additional cost associated with extracting one more unit of a resource.

Treasury Bill

A short-term government security issued at a discount from the par value and pays no interest, maturing in a year or less.

Q28: The following information is taken from the

Q74: Which of the following would be the

Q89: Jinnah Company applies overhead on the basis

Q102: The following information is available for completed

Q160: In performing a vertical analysis, the base

Q173: Because of automation, which component of product

Q184: The important end-product of the operating budgets

Q196: Fleming Company sells a product for $50

Q196: In an analogous sense, external user is

Q208: When units produced are greater than units