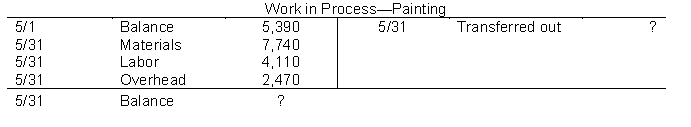

The ledger of Kinsler Company has the following work in process account.

Production records show that there were 700 units in the beginning inventory, 30% complete, 2,300 units started, and 2,500 units transferred. The beginning work in process had materials cost of $3,060 and conversion costs of $2,330. The units in ending inventory were 40% complete. Materials are entered at the beginning of the painting process.

Instructions

(a) How many units are in process at May 31?

(b) What is the unit materials cost for May?

(c) What is the unit conversion cost for May?

(d) What is the total cost of units transferred out in May?

(e) What is the cost of the May 31 inventory?

Definitions:

Tax Provision

An amount recorded in advance for expected future tax payments due to governmental regulations and business operations.

Interperiod Tax Allocation

The practice of distributing income tax expenses over different accounting periods to match taxes with the revenues they are associated with.

Book Income

The income reported by a company in its financial statements, differing from taxable income due to various adjustments.

Life Insurance Premiums

Regular payments made to an insurance company to maintain a life insurance policy.

Q24: A major difference between the annual budget

Q45: Cohen Manufacturing is trying to determine the

Q46: Graham Manufacturing is a small manufacturer that

Q59: Conversion cost per unit equals $6.00. Total

Q60: If the manufacturing overhead costs applied to

Q96: The predetermined overhead rate is based on

Q117: To which function of management is CVP

Q122: For better management acceptance, the flow of

Q141: Klinger Company estimates that annual manufacturing overhead

Q223: A ratio calculated in the analysis of