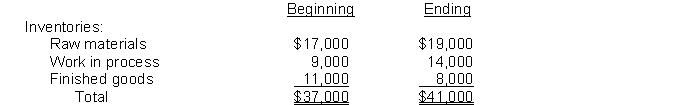

The following inventory information is available for Ricci Manufacturing Corporation for the year ended December 31, 2010:

In addition, the following transactions occurred in 2010:

1. Raw materials purchased on account, $75,000.

2. Incurred factory labor, $90,000, all is direct labor. (Credit Factory Wages Payable).

3. Incurred the following overhead costs during the year: Utilities $6,800, Depreciation on manufacturing machinery $8,000, Manufacturing machinery repairs $9,200, Factory insurance $9,000 (Credit Accounts Payable and Accumulated Depreciation).

4. Assigned $90,000 of factory labor to jobs.

5. Applied $36,000 of overhead to jobs.

Instructions

(a) Journalize the above transactions.

(b) Reproduce the manufacturing cost and inventory accounts. Use T-accounts.

(c) From an analysis of the accounts, compute the following:

1. Raw materials used.

2. Completed jobs transferred to finished goods.

3. Cost of goods sold.

4. Under- or overapplied overhead.

Definitions:

Wall Street

A symbol for the financial markets and institutions located in the Financial District of Lower Manhattan, New York City, often associated with the American financial sector and stock market.

Financial Firms

Businesses that provide financial services such as banking, investment, insurance, and asset management.

Rent Seeking

The practice of individuals or entities seeking to gain additional wealth without any contribution to productivity, typically through manipulation or exploitation of the economic environment.

Government

A system or group of people governing an organized community, often a state.

Q49: Factory labor should be assigned to selling

Q52: The statement of cash flows<br>A) must be

Q63: The amount by which actual or expected

Q88: A time ticket does not indicate the<br>A)

Q92: Directing includes<br>A) providing a framework for management

Q96: Edmiston Manufacturing Company reported the following year-end

Q108: A good system of internal control requires

Q166: A cost reconciliation schedule is prepared to

Q176: When there is no beginning work in

Q203: Fessler, Inc. has a product with a