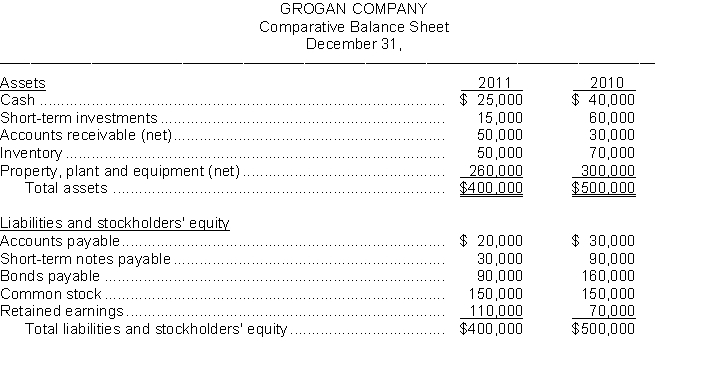

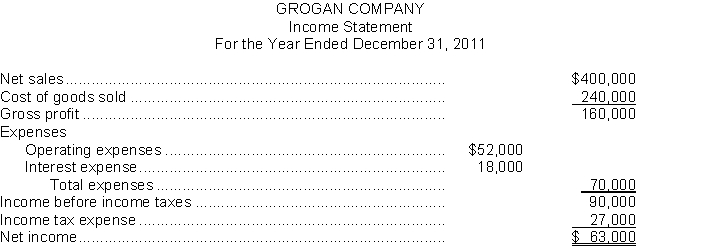

The financial statements of Grogan Company appear below:

Additional information:

a. Cash dividends of $23,000 were declared and paid in 2011.

b. Weighted-average number of shares of common stock outstanding during 2011 was 30,000 shares.

c. Market value of common stock on December 31, 2011, was $21 per share.

Instructions

Using the financial statements and additional information, compute the following ratios for Grogan Company for 2011. Show all computations.

Computations

1. Current ratio _________.

2. Return on common stockholders' equity _________.

3. Price-earnings ratio _________.

4. Acid-test ratio _________.

5. Receivables turnover _________.

6. Times interest earned _________.

7. Profit margin _________.

8. Days in inventory _________.

9. Payout ratio _________.

10. Return on assets _________.

a. Cash dividends of $23,000 were declared and paid in 2011.

b. Weighted-average number of shares of common stock outstanding during 2011 was 30,000 shares.

c. Market value of common stock on December 31, 2011, was $21 per share.

Instructions

Using the financial statements and additional information, compute the following ratios for Grogan Company for 2011. Show all computations.

Computations

Definitions:

Economic Elites

A group of people who possess a disproportionate amount of wealth and economic power in a society.

Middle Classes

A social group between the upper and working classes, characterized by moderate to high income levels, education, and professional occupations.

Constitutional Protections

Legal safeguards enshrined in a country's constitution, aimed at ensuring the rights and liberties of its citizens are protected against government infringement.

Titular Democracies

Political systems that have the formal appearance of a democracy through elections and institutions, but lack substantive democratic practices, such as respect for civil liberties and genuine political competition.

Q4: Free cash flow equals cash provided by<br>A)

Q34: Tolan Co. purchased 60, 6% Irick Company

Q47: Data for the cost of direct materials

Q57: Gains and losses are not recognized when

Q89: If $150,000 face value bonds are issued

Q95: Jacobs Corporation makes a short-term investment in

Q104: The major reporting standard for presenting managerial

Q116: Waters Department Store had net credit sales

Q122: Foster Manufacturing uses a job order cost

Q143: Lanier industries owns 45% of McCoy Company.