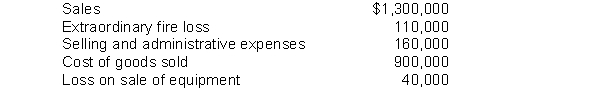

Winfrey Corporation gathered the following information for the fiscal year ended December 31, 2010:

Winfrey Corporation is subject to a 30% income tax rate.

Instructions

Prepare a partial income statement, beginning with income before income taxes.

Definitions:

Owner's Capital

Represents the total equity belonging to the owners of a company or business, reflecting the net assets minus liabilities.

Accounts Receivable

Money owed to a company by its customers from sales or services rendered on credit, recorded as an asset on the balance sheet.

Accounts Payable

Liabilities of a business arising from credit purchases from suppliers, displayed on the company's balance sheet as money owed.

Assets Sold

The sale of company assets, which could include equipment, properties, or other resources owned by the company.

Q8: Which one of the following does not

Q27: The following amounts were taken from the

Q49: Barton Company has beginning work in process

Q89: During 2010, Klugman Industries reported cash provided

Q100: Vertical analysis is a technique which expresses

Q130: Which one of the following ratios would

Q131: In preparing a statement of cash flows,

Q155: Long-term liabilities are reported in a separate

Q157: Banner Company had total operating expenses of

Q200: Miley Corporation had net income of $250,000