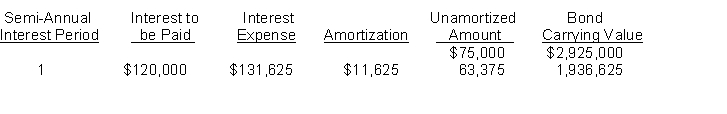

On June 30, 2010, Wayne, Inc. sold $3,000,000 (face value) of bonds. The bonds are dated June 30, 2010, pay interest semiannually on December 31 and June 30, and will mature on June 30, 2013. The following schedule was prepared by the accountant for 2010.

Instructions

On the basis of the above information, answer the following questions. (Round your answer to the nearest dollar or percent.)

1. What is the stated interest rate for this bond issue?

2. What is the market interest rate for this bond issue?

3. What was the selling price of the bonds as a percentage of the face value?

4. Prepare the journal entry to record the sale of the bond issue on June 30, 2010.

5. Prepare the journal entry to record the payment of interest and amortization on December 31, 2010.

Definitions:

Client-visits

Client-visits refer to the number of times clients visit a business or service provider, often used to measure customer engagement or service utilization.

Activity Variance

The difference between the budgeted cost of activity based on standard rates and the actual cost incurred.

Budgeting

The process of creating a plan to spend your money over a certain period, allocating funds to various activities or departments.

Customers Served

The number of unique clients or customers that a business or service has provided for over a specific period.

Q3: Salary allowances to partners are a major

Q31: The present value of a $10,000, 5-year

Q76: Under the equity method of accounting for

Q79: Common Stock Dividends Distributable is shown within

Q97: Presented here is a partial amortization schedule

Q111: Richman Corporation has 120,000 shares of $5

Q118: Limited partnerships<br>A) must have at least one

Q141: Secured bonds are bonds that<br>A) are in

Q166: On the statement of cash flows worksheet,<br>A)

Q174: Allstate, Inc., has 10,000 shares of 6%,