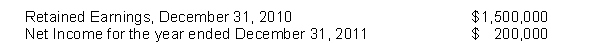

The following information is available for Piper Corporation:

The company accountant, in preparing financial statements for the year ending December 31, 2011, has discovered the following information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on a machine in 2009 and 2010 using the double-declining-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effects of the error on prior years was $20,000, ignoring income taxes. Depreciation was computed by the straight-line method in 2011.

Instructions

(a) Prepare the entry for the prior period adjustment.

(b) Prepare the retained earnings statement for 2011.

Definitions:

Tolerance

The capacity to endure continued exposure to a substance or activity without adverse reaction, often leading to the need for increased amounts to achieve the same effect.

Physical Dependence

A physiological state of adaptation to a substance, resulting in withdrawal symptoms when that substance is reduced or stopped.

Nucleus Accumbens

A region in the brain involved in the reward circuit, associated with pleasure, reinforcement learning, addiction, and fear.

Reward Pathway

A neural pathway in the brain that is activated by rewarding stimuli, playing a critical role in the reinforcement and motivation processes.

Q32: The Butkus, Sayers, and Halas partnership is

Q58: If the cost method is used to

Q60: Discount on bonds is an additional cost

Q76: If a partner invests noncash assets in

Q77: The interest charged on a $50,000 note

Q98: A separate paid-in capital account is used

Q127: When the selling price of treasury stock

Q140: Preferred stockholders generally do not have the

Q180: When stock is issued for legal services,

Q202: The human resources department documents and authorizes