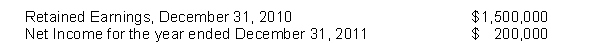

The following information is available for Piper Corporation:

The company accountant, in preparing financial statements for the year ending December 31, 2011, has discovered the following information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on a machine in 2009 and 2010 using the double-declining-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effects of the error on prior years was $20,000, ignoring income taxes. Depreciation was computed by the straight-line method in 2011.

Instructions

(a) Prepare the entry for the prior period adjustment.

(b) Prepare the retained earnings statement for 2011.

Definitions:

Cortical Atrophy

The reduction of brain tissue in the cerebral cortex, often associated with age, neurological diseases, or conditions affecting brain health.

Schizophrenia

Behavioral disorder characterized by delusions, hallucinations, disorganized speech, blunted emotion, agitation or immobility, and a host of associated symptoms.

Temporal Cortex

The cortex within the temporal lobe involved in processing sensory input into derived meanings for the appropriate retention of visual memory, language comprehension, and emotion association.

Frontal Cortex

A region of the brain located in the frontal lobe, involved in decision making, problem solving, control of purposeful behaviors, consciousness, and emotions.

Q50: The lessee must record a lease as

Q60: Discount on bonds is an additional cost

Q60: The contra-account, Market Adjustment, is also called

Q76: Under the equity method of accounting for

Q83: A corporation purchases 20,000 shares of its

Q103: Premium on Bonds Payable<br>A) has a debit

Q136: Kendrick Corporation was organized on January 2,

Q140: If bonds are originally sold at a

Q146: If $800,000, 6% bonds are issued on

Q194: On September 1, Joe's Painting Service borrows