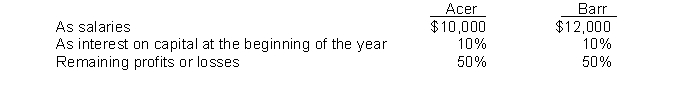

Partners Acer and Barr have capital balances in a partnership of $40,000 and $60,000, respectively. They agree to share profits and losses as follows:  If income for the year was $50,000, what will be the distribution of income to Barr?

If income for the year was $50,000, what will be the distribution of income to Barr?

Definitions:

T-test

A statistical test used to compare the means of two groups or test a single mean against a known value.

Critical Value

A point on the scale of the test statistic beyond which we reject the null hypothesis; it defines the cutoff between significance and non-significance.

Null Hypothesis

A hypothesis that suggests there is no significant difference between specified populations, or no association among groups.

Null Hypothesis

A statistical hypothesis that assumes no effect or no difference in an experiment or study, serving as the default assumption to be tested.

Q19: If stock is issued for a noncash

Q21: The concept of an "artificial being" refers

Q68: A company purchased office equipment for $40,000

Q79: A plant asset must be fully depreciated

Q117: A current liability is a debt the

Q159: If preferred stock is cumulative, the<br>A) preferred

Q177: FICA taxes are a deduction from employee

Q184: Partnership income or loss need not be

Q194: On September 1, Joe's Painting Service borrows

Q254: The declining-balance method of depreciation produces<br>A) a