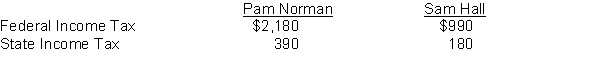

Pam Norman had earned (accumulated) salary of $96,000 through November 30. Her December salary amounted to $8,500. Sam Hall began employment on December 1 and will be paid his first month's salary of $5,000 on December 31. Income tax withholding for December for each employee is as follows:

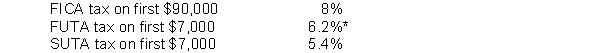

The following payroll tax rates are applicable:

*Less a credit equal to the state unemployment contribution

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll.

Definitions:

Interpersonal Influences

Interpersonal influences involve the impact that individuals have on each other's attitudes, beliefs, and behaviors, often through social interaction, persuasion, and group dynamics.

Perceived Self-efficacy

An individual's belief in their own ability to succeed in specific situations or accomplish a task.

Situational Influences

External factors that affect an individual's behavior or decision-making process in a given context.

Promotion and Maintenance

The actions and strategies implemented to enhance and preserve the well-being, functionality, or status of something or someone.

Q7: A truck was purchased for $120,000 and

Q78: A debit balance in the Allowance for

Q101: If a contingent liability is reasonably estimable

Q152: On February 1, 2010, Janssen Company sells

Q170: Which of the following is not an

Q175: On December 1, Gilman Corporation borrowed $5,000

Q176: Julie Norman, earns $20 per hour for

Q182: Presto Company purchased equipment and these costs

Q194: On September 1, Joe's Painting Service borrows

Q209: If a bonus is given to a