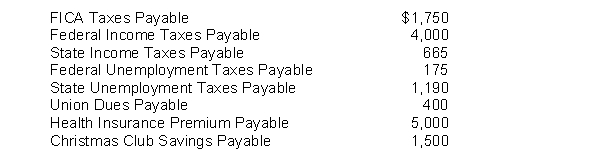

The following payroll liability accounts are included in the ledger of Eckstrom Company on January 1, 2010:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,750 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Sent a $1,500 check to a Savings and Loan for the Christmas Club withholdings.

Instructions

Journalize the January transactions

Definitions:

Haustoria

Specialized structures of parasitic or symbiotic fungi and plants that penetrate the host's tissue to absorb nutrients.

Adventitious

Referring to structures that develop in an unusual place, such as roots growing from stems or leaves instead of from the plant's root system.

Taproots

A type of root system characterized by a single, large, central root that grows vertically downward and gives off smaller lateral roots.

Mycorrhizal

Referring to the symbiotic association between a fungus and the roots of a vascular plant, enhancing nutrient and water uptake.

Q41: The following totals for the month of

Q95: Goodwill is not recognized in accounting unless

Q130: Notes payable are often used instead of

Q144: Using the percentage of receivables method for

Q149: A plant asset cost $144,000 and is

Q161: With an interest-bearing note, a borrower must

Q163: The declining-balance method of computing depreciation is

Q164: When vacant land is acquired, expenditures for

Q175: To determine a new depreciation amount after

Q178: In reviewing the accounts receivable, the cash