Essay

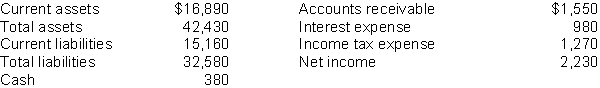

Mehring's 2010 financial statements contained the following data (in millions).

Instructions

Compute these values:

(a) Working capital. (b) Current ratio.

Definitions:

Related Questions

Q22: Rooney Company incurred $280,000 of research and

Q36: All of the following are intangible assets

Q56: A-Amortization P-Depletion<br>D-Depreciation N-None of these<br>1. Goodwill <br>2.

Q73: Sales taxes collected by the retailer are

Q120: The amount of sales tax collected by

Q129: Which of the following payroll taxes are

Q181: The partnership agreement of Nieto, Keller, and

Q194: The account Allowance for Doubtful Accounts is

Q208: The retailer considers Visa and MasterCard sales

Q251: Equipment costing $30,000 with a salvage value