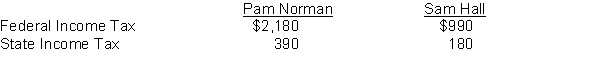

Pam Norman had earned (accumulated) salary of $96,000 through November 30. Her December salary amounted to $8,500. Sam Hall began employment on December 1 and will be paid his first month's salary of $5,000 on December 31. Income tax withholding for December for each employee is as follows:

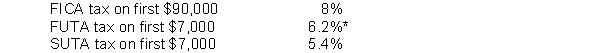

The following payroll tax rates are applicable:

*Less a credit equal to the state unemployment contribution

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll.

Definitions:

Standardization

The process of implementing and developing technical standards to maximize compatibility, efficiency, and quality among products and systems.

Differentiation

A marketing strategy where a company designs its products or services to be unique and attractive to a specific customer segment, setting it apart from competitors.

Marketing Strategy

A comprehensive plan formulated by businesses to achieve specific marketing objectives.

Global Corporations

Large multinational companies that operate and provide goods or services in multiple countries around the world.

Q26: Equipment was purchased for $75,000. Freight charges

Q29: Crawford Company has total proceeds (before segregation

Q41: Which of the following is not a

Q95: Goodwill is not recognized in accounting unless

Q124: Miley Enterprises sold equipment on January 1,

Q139: Santo Company and Renfro Company decide to

Q185: Once an asset is fully depreciated, no

Q189: The current portion of long-term debt should<br>A)

Q210: An aging of a company's accounts receivable

Q244: A truck that cost $21,000 and on