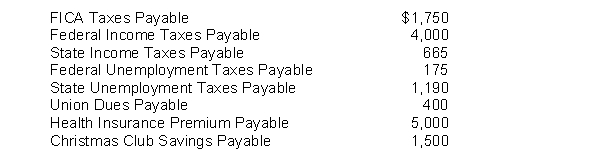

The following payroll liability accounts are included in the ledger of Eckstrom Company on January 1, 2010:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,750 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Sent a $1,500 check to a Savings and Loan for the Christmas Club withholdings.

Instructions

Journalize the January transactions

Definitions:

Strict Product Liability Theory

A legal doctrine that holds a seller, distributor, or manufacturer liable for any damages caused by a defective product, regardless of fault.

Reasonably Foreseeable Party

Individuals or entities who can reasonably be expected to be affected by decisions or actions, especially in the context of duty of care in negligence cases.

Design Defect

A defect that is found in all products of a particular design and renders them dangerous.

Toy Manufacturer

A company or individual engaged in the production of toys for children.

Q22: The liquidation of a partnership means that

Q40: Lincoln Company sells 600 units of a

Q44: When the due date of a note

Q78: A debit balance in the Allowance for

Q86: The financial statements of Gentry Manufacturing Company

Q99: Both accounts receivable and notes receivable represent

Q158: Information that is not generally reported for

Q197: On March 1, Jordan Company borrows $90,000

Q250: Gurney Company sold equipment on July 31,

Q268: When estimating the useful life of an