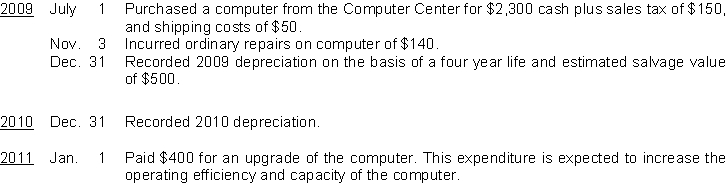

Eckan Word Processing Service uses the straight-line method of depreciation. The company's fiscal year end is December 31. The following transactions and events occurred during the first three years.

Instructions

Prepare the necessary entries. (Show computations.)

Definitions:

After-Tax Lorenz Curve

A graphical representation that shows the distribution of income or wealth within an economy after accounting for taxes.

Before-Tax Lorenz Curve

A graphical representation that shows the distribution of income or wealth among individuals or households before taxes are applied.

Lorenz Curve

A graphical representation of income or wealth distribution within a society, showing the proportion of overall income earned by cumulative percentages of the population.

Income Inequality

The imbalanced dispersion of income across various economic participants, including individuals and households.

Q6: On April 30, the bank reconciliation of

Q35: Liabilities are classified on the balance sheet

Q102: On March 9, Fillmore gave Camp Company

Q111: A contingent liability is recorded when the

Q117: A plant asset was purchased on January

Q138: The percentage of sales basis for estimating

Q180: Two federal taxes which are levied against

Q195: Depreciation is the process of allocating the

Q239: Recording depreciation each period is necessary in

Q257: The cost of natural resources is not