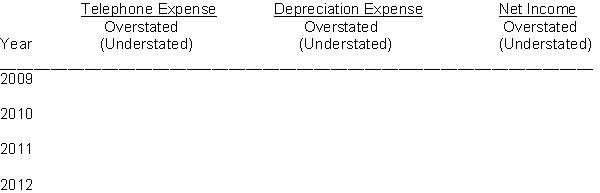

On January 1, 2008 Marsh Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2009 more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Telephone Expense. Marsh Company uses the straight-line method of depreciation.

Instructions

Prepare a schedule showing the effects of the error on Telephone Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2009 through the useful life of the new equipment.

Definitions:

Renewal Price

Renewal price refers to the price at which a service, contract, or subscription can be renewed after the initial term ends.

Mortality Rate

A measure of the number of deaths in a particular population, scaled to the size of that population per unit of time.

Lost Earnings

The income that an individual fails to earn because of unemployment, illness, or other reasons that prevent them from working.

Aerial Acrobats

Performers who execute intricate maneuvers and stunts while suspended in the air, often using equipment like trapezes, ropes, or silks.

Q27: Requiring employees to take vacations is a

Q41: The following totals for the month of

Q53: A highly automated computerized system of accounting

Q88: The principles of internal control include all

Q98: Hadicke Company purchased a delivery truck for

Q108: An accounts receivable subsidiary ledger has all

Q124: Miley Enterprises sold equipment on January 1,

Q152: On February 1, 2010, Janssen Company sells

Q188: When credit sales are made, _ Expense

Q209: If a petty cash fund is established