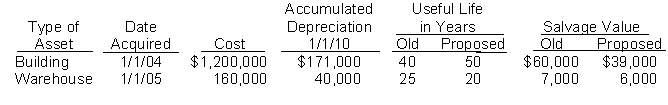

Steve White the new controller of Weinberg Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2010. His findings are as follows.

All assets are depreciated by the straight-line method. Weinberg Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Steve's proposed changes.

Instructions

(a) Compute the revised annual depreciation on each asset in 2010. (Show computations.)

(b) Prepare the entry (or entries) to record depreciation on the building in 2010.

Definitions:

Subsidiary Motions

Procedures used in meetings and parliamentary settings to modify, delay, or affect the decision-making process on main motions.

Privileged Motions

Motions that have priority over other types of motions in parliamentary procedure, addressing urgent matters.

Incidental Motions

Procedural motions in parliamentary procedure that address issues that arise incidentally during the consideration of other matters.

Main Motions

Formal proposals put forward for debate and decision within a meeting, constituting the primary subject matter around which discussions revolve.

Q2: The petty cash fund of $200 for

Q8: The Jones and Yancey partnership reports net

Q39: The maturity value of a $90,000, 10%,

Q41: Angie's Blooms purchased a delivery van for

Q63: Two limitations of systems of internal control

Q72: The journal entry to record the payroll

Q82: Warranty expenses are reported on the income

Q157: Dayton Mining Company purchased land containing an

Q206: Layton Company does not ring up sales

Q282: Management should select the depreciation method that<br>A)