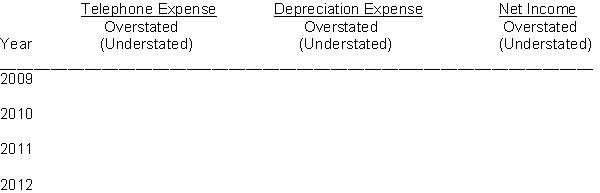

On January 1, 2008 Marsh Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2009 more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Telephone Expense. Marsh Company uses the straight-line method of depreciation.

Instructions

Prepare a schedule showing the effects of the error on Telephone Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2009 through the useful life of the new equipment.

Definitions:

Criminal Justice System

The system of practices and institutions of governments aimed at upholding social control, deterring and mitigating crime, and sanctioning those who violate laws with criminal penalties and rehabilitation efforts.

Reflection Technique

A method involving thoughtful consideration of one's actions and experiences to gain insights and improve future performance.

Learning Contract

is an agreement between a learner and educator outlining specific learning objectives, resources, and evaluation criteria.

Relationship Triad

A model or concept in psychology and sociology that examines the dynamic interplay among three parties or elements in a relationship system.

Q10: Sales resulting from the use of Visa

Q12: A purchased patent has a legal life

Q33: On July 4, 2010, Wyoming Mining Company

Q44: Yanik Company's delivery truck, which originally cost

Q130: Identify the internal control procedures applicable to

Q163: The declining-balance method of computing depreciation is

Q166: Sargent Corporation bought equipment on January 1,

Q181: A company maintains the asset account, Cash

Q182: Internal control is mainly concerned with the

Q231: An exchange of plant assets has commercial