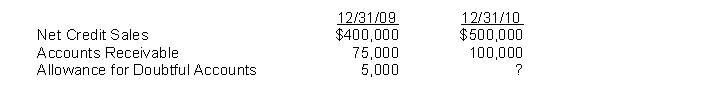

Coffeldt Sign Company uses the allowance method in accounting for uncollectible accounts. Past experience indicates that 1% of net credit sales will eventually be uncollectible. Selected account balances at December 31, 2009, and December 31, 2010, appear below:

Instructions

(a) Record the following events in 2010.

Aug. 10 Determined that the account of Sue Lang for $1,000 is uncollectible.

Sept. 12 Determined that the account of Tom Woods for $4,000 is uncollectible.

Oct. 10 Received a check for $550 as payment on account from Sue Lang, whose account had previously been written off as uncollectible. She indicated the remainder of her account would be paid in November.

Nov. 15 Received a check for $450 from Sue Lang as payment on her account.

(b) Prepare the adjusting journal entry to record the bad debt provision for the year ended December 31, 2010.

(c) What is the balance of Allowance for Doubtful Accounts at December 31, 2010?

Definitions:

Q13: A debit column for Sales Returns and

Q80: A one-column purchases journal is used to

Q84: Don's Copy Shop bought equipment for $90,000

Q86: Under the lower-of-cost-or-market basis, market is defined

Q106: Which of the following assets does not

Q135: The LIFO inventory method assumes that the

Q140: Equipment with an invoice price of $20,000

Q148: Neighborly Industries has the following inventory information.

Q189: A plant asset acquired on October 1,

Q285: Depreciable cost is the<br>A) book value of