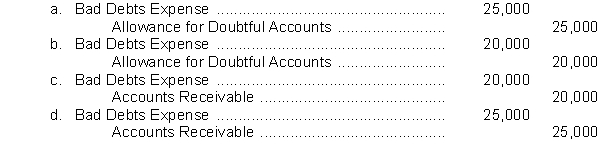

Hahn Company uses the percentage of sales method for recording bad debts expense. For the year, cash sales are $500,000 and credit sales are $2,000,000. Management estimates that 1% is the sales percentage to use. What adjusting entry will Hahn Company make to record the bad debts expense?

Definitions:

Straight-Line Method

A depreciation technique where an equal amount of depreciation expense is allocated for each year of the asset's useful life.

Q13: A debit column for Sales Returns and

Q60: Gary Dittman, an employee of Hopkins Company,

Q60: A plant asset originally cost $48,000 and

Q63: A company purchases a remote site building

Q82: In preparing its bank reconciliation for the

Q91: A company that receives an interest bearing

Q96: Tayler Company wrote checks totaling $17,080 during

Q103: The amounts appearing in the Merchandise Inventory

Q110: If a company records merchandise it returns

Q121: Notes receivable are recognized in the accounts