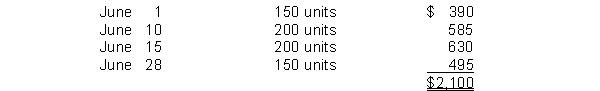

A company just starting business made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand. Using the average-cost method, the amount allocated to the ending inventory on June 30 is

A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand. Using the average-cost method, the amount allocated to the ending inventory on June 30 is

Definitions:

Sales-leaseback Transaction

A financial arrangement where one sells an asset and immediately leases it back from the buyer, effectively freeing up cash while retaining the use of the asset.

Seller-lessee

In a sale-leaseback transaction, the original owner who sells an asset and then leases it back from the new owner, retaining possession and use of the asset.

Deferred

Postponed or delayed; in financial terms, it often refers to expenses or income that will be realized at a future date.

Operating Lease

A leasing agreement allowing one party to use an asset owned by another party for a specified time period without ownership transfer.

Q7: Cartier Company purchased inventory from Pissaro Company.

Q13: On October 1, Belton Bicycle Store had

Q35: During August, 2010, Joe's Supply Store generated

Q74: Kershaw Bookstore had 500 units on hand

Q91: Two widely used methods of estimating inventories

Q103: Below are descriptions of internal control problems.

Q135: In a perpetual inventory system, the Cost

Q142: Net purchases plus freight-in determines<br>A) cost of

Q159: The owner's drawing account is a permanent

Q180: Rasner Co. returned defective goods costing $3,000