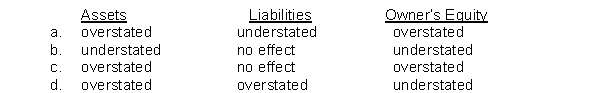

Euler Company made an inventory count on December 31, 2010. During the count, one of the clerks made the error of counting an inventory item twice. For the balance sheet at December 31, 2010, the effects of this error are

Definitions:

Straight-Line Depreciation

A tactic for parceling the cost of a tangible property throughout its lifespan in steady yearly payments.

Income Taxes

Taxes imposed by a government on the financial income generated by all entities within their jurisdiction.

Cash Flow

The inflow and outflow of cash representing the operating activities of an organization.

Working Capital

The difference between a company's current assets and current liabilities, indicating operational liquidity.

Q4: A $100 petty cash fund has cash

Q8: Which of the following is not a

Q21: The Sales Returns and Allowances account is

Q55: Kegin Company sells many products. Whamo is

Q75: Purchase Returns and Allowances and Purchase Discounts

Q94: If the unit price of inventory is

Q97: The following items are taken from the

Q109: The basic principles of an accounting information

Q152: In a manufacturing company, goods that are

Q205: At April 30, Mareska Company has the