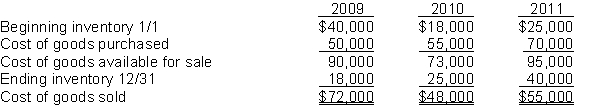

Speer's Hardware Store prepared the following analysis of cost of goods sold for the previous three years:

Net income for the years 2007, 2008, and 2009 was $70,000, $60,000, and $55,000, respectively. Since net income was consistently declining, Mr. Speer hired a new accountant to investigate the cause(s) for the declines.

The accountant determined the following:

1. Purchases of $25,000 were not recorded in 2009.

2. The 2009 December 31 inventory should have been $24,000.

3. The 2010 ending inventory included inventory costing $5,000 that was purchased FOB destination and in transit at year end.

4. The 2011 ending inventory did not include goods costing $4,000 that were shipped on December 29 to Sampson Plumbing Company, FOB shipping point. The goods were still in transit at the end of the year.

Instructions

Determine the correct net income for each year. (Show all computations.)

Definitions:

Q7: An auto manufacturer would classify vehicles in

Q29: An adjusting entry always involves two balance

Q54: Listed below are various column headings that

Q56: The "Other Accounts" column in a cash

Q66: A worksheet is a multiple column form

Q72: On a classified balance sheet, merchandise inventory

Q73: If a certain type of transaction occurs

Q152: The principle of establishing responsibility does not

Q157: Control over cash disbursements is generally more

Q194: The cash account shows a balance of