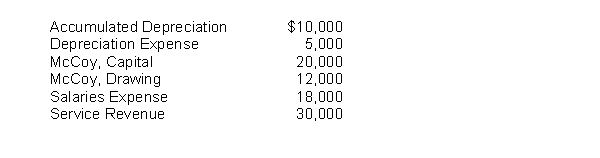

Prepare the necessary closing entries based on the following selected accounts.

Definitions:

Distributions to Retirees

Payments made from a pension, retirement plan, or profit-sharing plan to retired employees or beneficiaries.

Marginal Tax Rates

The percentage of tax applied to an individual's or entity’s income for every additional dollar earned, indicating the rate at which the next dollar of taxable income will be taxed.

Short-term Pension Risk Ratio

A measure assessing the risk associated with a pension plan's ability to meet its short-term obligations.

Funded Status

A measure of the financial health of a pension plan, calculated as the difference between plan assets and liabilities.

Q21: The consistent application of an inventory costing

Q29: Selected worksheet data for Carpenter Company are

Q46: Every sales transaction should be supported by

Q55: Match the items below by entering the

Q62: The Duce Company has five plants nationwide

Q74: A journal provides<br>A) the balances for each

Q145: In the first month of operations, the

Q151: A company's unadjusted balance in Merchandise Inventory

Q159: The owner's drawing account is a permanent

Q170: At January 1, 2010, LeAnna Industries reported