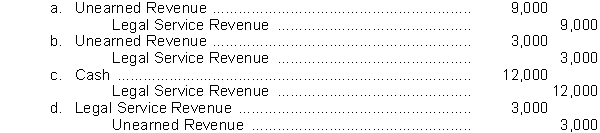

Mike Conway is a lawyer who requires that his clients pay him in advance of legal services rendered. Mike routinely credits Legal Service Revenue when his clients pay him in advance. In June Mike collected $12,000 in advance fees and completed 75% of the work related to these fees. What adjusting entry is required by Mike's firm at the end of June?

Definitions:

Hypertension

A medical condition characterized by consistently high blood pressure levels, which can lead to serious health issues if left untreated.

European Americans

Individuals residing in the United States who are of European descent, one of the various ethnic groups in the country.

African Americans

An ethnic group in the United States with ancestry in the black racial groups of Africa.

Surgeon General's Report

Periodic publications issued by the U.S. Surgeon General that cover important public health issues, providing comprehensive information based on evidence and research.

Q6: Taylor Industries purchased supplies for $1,000. They

Q10: Benito Company began the year with owner's

Q44: Accountants who are employees of business enterprises

Q103: _, _, and _ have debit normal

Q104: Price Company earned net income of $43,000

Q136: The adjusting entry at the end of

Q147: An account consists of<br>A) one part.<br>B) two

Q156: Unearned revenue is a prepayment that requires

Q171: Sales revenue<br>A) may be recorded before cash

Q180: Expenses sometimes make their contribution to revenue