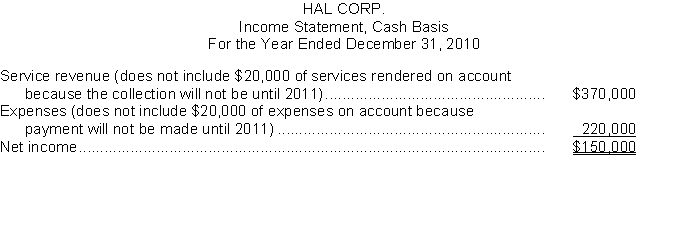

Hal Corp. prepared the following income statement using the cash basis of accounting:

Additional data:

1. Depreciation on a company automobile for the year amounted to $6,000. This amount is not included in the expenses above.

2. On January 1, 2010, paid for a two-year insurance policy on the automobile amounting to $1,800. This amount is included in the expenses above.

Instructions

(a) Recast the above income statement on the accrual basis in conformity with generally accepted accounting principles. Show computations and explain each change.

(b) Explain which basis (cash or accrual) provides a better measure of income.

Definitions:

Disposable Supplies

Medical or laboratory items intended for one-time or temporary use to ensure hygiene and reduce the risk of contamination.

Physical Examination

A thorough assessment and evaluation of a person's body and its functions using inspection, palpation, percussion, and auscultation.

Accessibility

The ease with which people can move into and out of a space.

Ultrasonic Cleaner

A cleaning device that uses ultrasound waves and an appropriate cleaning solution to clean delicate items.

Q8: Joyce's Gifts signs a three-month note payable

Q76: The adjustments on a worksheet can be

Q92: Which one of the following is not

Q124: The following items are taken from the

Q124: Accounting time periods that are one year

Q128: On June 1, during its first month

Q138: Which of the following is not true

Q148: Closing entries are journalized and posted<br>A) before

Q159: The process of recording transactions has become

Q176: Bee-In-The-Bonnet Company purchased office supplies costing $6,000