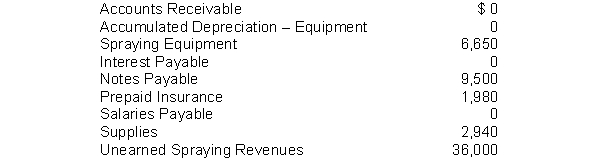

Ben Cartwright Pest Control has the following balances in selected accounts on December 31, 2010.

All of the accounts have normal balances. The information below has been gathered at December 31, 2010.

1. Depreciation on the equipment for 2010 is $1,250.

2. Ben Cartwright Pest Control borrowed $12,500 by signing a 10%, one-year note on July 1, 2010.

3. Ben Cartwright Pest Control paid $1,980 for 12 months of insurance coverage on October 1, 2010.

4. Ben Cartwright Pest Control pays its employees total salaries of $10,000 every Monday for the preceding 5-day week (Monday-Friday). On Monday, December 27, 2010, employees were paid for the week ending December 24, 2010. All employees worked the five days ending December 31, 2010.

5. Ben Cartwright Pest Control performed disinfecting services for a client in December 2010. The client will be billed $3,000.

6. On December 1, 2010, Ben Cartwright Pest Control collected $36,000 for disinfecting processes to be performed from December 1, 2010, through May 31, 2010.

7. A count of supplies on December 31, 2010, indicates that supplies of $750 are on hand.

Instructions

Prepare in journal form with explanations, the adjusting entries for the seven items listed for Ben Cartwright Pest Control.

Definitions:

Nonverbal Cues

Communication without words, including gestures, body language, facial expressions, and other visual and auditory signs.

Equal Employment Opportunity Commission

A U.S. federal agency that enforces laws prohibiting workplace discrimination and advocates for fair treatment in employment regardless of race, religion, sex, nationality, age, disability, or genetic information.

Employment Discrimination

Unfair treatment of employees or job applicants based on race, color, religion, sex, national origin, age, disability, or genetic information.

Family and Medical Leave Act

A U.S. federal law that provides eligible employees with unpaid, job-protected leave for specific family and medical reasons.

Q6: Taylor Industries purchased supplies for $1,000. They

Q10: Indicate the worksheet column (income statement Dr.,

Q17: Posting<br>A) should be performed in account number

Q18: Determining the need for labor, machines, physical

Q37: An adjusting entry requiring a credit to

Q71: Credits<br>A) decrease both assets and liabilities.<br>B) decrease

Q105: It is not necessary to prepare formal

Q137: The three major services rendered by a

Q146: An account is a part of the

Q206: A liability-revenue relationship exists with<br>A) prepaid expense