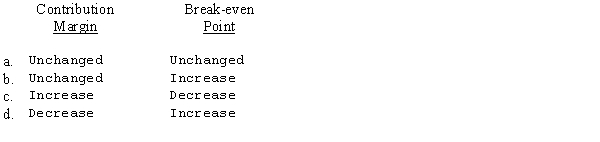

If the fixed costs related to a product increase while variable costs and sales price remain constant, what will happen to (1) contribution margin and (2) break-even point?

Definitions:

IRR

Internal Rate of Return; a metric used in capital budgeting to estimate the profitability of potential investments, representing the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

NPV

Net Present Value, a method used in capital budgeting to assess the profitability of an investment or project by calculating the present value of expected future cash flows minus initial costs.

Replacement Chain Approach

The Replacement Chain Approach is a method used in capital budgeting to compare projects of unequal lifespans by replicating them until they reach a common end point, facilitating fair comparison.

Cost of Capital

The rate of return that a business needs to generate in order to cover the cost of generating new capital, which can include debt and equity.

Q12: All of the following are characteristics of

Q33: a. Compute the mean.<br>b. Compute the median.

Q33: A company uses a two-variance analysis for

Q35: Find the probability that the ice cream

Q43: The normal capacity of Noel Company is

Q56: When selecting a method of inventory costing,

Q62: Which of the following is a

Q64: A law firm has submitted bids on

Q66: In a period of rising prices, the

Q125: Which of the following statements is