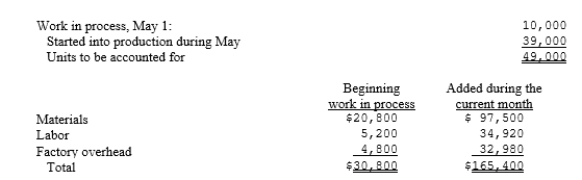

The Roberto Company had computed the flow of units for Department A for the month of May as follows:  Materials are added at the beginning of the process. There were 8,000 units of work in process at May 31. The work in process at May 1 was 70 percent complete as to conversion costs and the work in process at May 31 was 60 percent complete as to conversion costs. What was the cost of the goods transferred out and in ending work in process using the FIFO method?

Materials are added at the beginning of the process. There were 8,000 units of work in process at May 31. The work in process at May 1 was 70 percent complete as to conversion costs and the work in process at May 31 was 60 percent complete as to conversion costs. What was the cost of the goods transferred out and in ending work in process using the FIFO method?

Definitions:

Proportional

A concept where elements are in a constant relationship in terms of size, amount, or number relative to a whole.

Regressive

Describing a tax system where the tax rate decreases as the taxpayer’s income increases, placing a larger burden on lower-income individuals.

Taxable Income

Taxable income is the portion of your gross income that's subject to taxes after deductions and exemptions.

Tax Liability

The total amount of tax owed to the government after all deductions, credits, and prepayments have been taken into account.

Q6: The cash provided by (used in) financing

Q6: Which of the following would cause the

Q7: Kerry Kola Company sells Kerry Kola in

Q28: When evaluating profitability of a segment, costs

Q29: Information concerning Department A of Ali Company

Q34: Kyle, Inc., instituted a new process in

Q35: Under which of the following conditions will

Q46: An example of a distribution cost that

Q74: In a three-variance method of factory overhead

Q75: During calendar 2020, Marcellus Inc. sold equipment