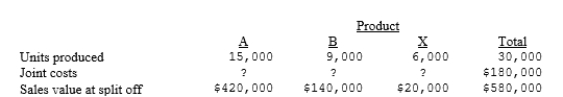

Nate Company manufactures Products A and B from a joint process that also yields a by-product, X. Nate Company accounts for the revenue from its by-product sales as a deduction from the cost of its main products. Additional information is as follows:  (1) Assuming that joint product costs are allocated using the relative sales value at split-off approach, what was the joint cost allocated to Products A and B?

(1) Assuming that joint product costs are allocated using the relative sales value at split-off approach, what was the joint cost allocated to Products A and B?

(2) Prepare the journal entry to transfer the finished products to separate inventory accounts.

(3) Assuming the sales value of X is stable, prepare the journal entries to:

(a) place the by-product in stock

(b) record the sale of 3,000 units for $10,500 on account.

Definitions:

Indirect Business Taxes

Taxes imposed on goods and services that indirectly affect companies, such as sales tax or value-added tax.

Depreciation

The reduction in the value of an asset over time, often due to wear and tear or obsolescence.

Net Domestic Product

The total value of all goods and services produced within a country in a specific period, minus depreciation.

Depreciation

The process of allocating the cost of a tangible asset over its useful life, reflecting a decrease in its value over time.

Q5: Consider the following about Taylor Corporation: <img

Q8: The following data represent the weights

Q9: What is the total effect of the

Q13: The balance in Kayser Manufacturing Company's Finished

Q21: Domino Consulting has two departments, Information Technology

Q33: The cash provided by investing activities in

Q36: The information in a statement of cash

Q43: When evaluating profitability of a segment, costs

Q71: When preparing a statement of cash

Q131: How is the value of the correlation