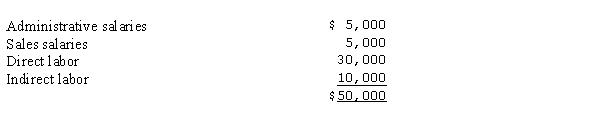

Harmony Company has accrued payroll costs of $50,000 for the period May 28 - 31 as follows:  Other Information: (a) The FICA rate is 8% of the first $100,000 of wages. None of the employees has reached this maximum.

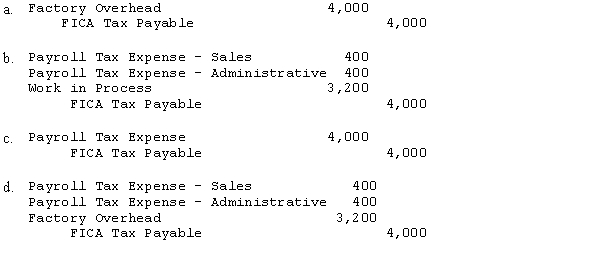

Other Information: (a) The FICA rate is 8% of the first $100,000 of wages. None of the employees has reached this maximum.

(b) The company is responsible for state and federal unemployment taxes on the first $8,000 of wages. All of the employees have previously reached this maximum.

(c) Payroll taxes are spread over all jobs.

What entry would be necessary to accrue payroll taxes for the period of May 28 - 31?

Definitions:

Budgeted Fixed Overhead

The estimated amount of fixed costs that a business plans to incur over a certain period, usually for budgetary and planning purposes.

Production Activity

Processes involved in making goods, from raw materials to finished products.

Variable Costing

An accounting method where only variable production costs are included in product cost, with fixed overhead costs treated as period expenses.

Absorption Costing

An accounting method that includes all manufacturing costs (direct materials, direct labor, and both variable and fixed manufacturing overhead) in the cost of a product.

Q8: If a company receives a larger quantity

Q10: Which of the following is not likely

Q14: Counterbalancing errors do NOT include<br>A) errors that

Q26: The inventory method which results in the

Q40: The entry made in November to reverse

Q41: Process costing techniques should be used in

Q59: In a factory, all of the following

Q64: On January 1, 2020, Marlene Corp. enters

Q70: Selected data concerning the past fiscal year's

Q100: On January 1, 2020, Dionne Ltd. signs